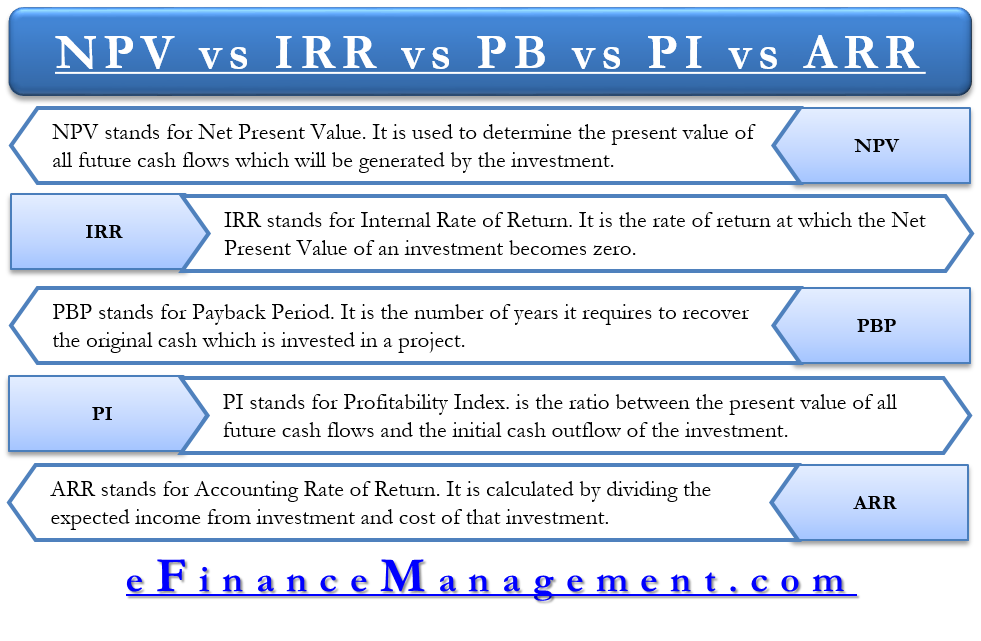

CAPITAL BUDGETING Decision methods: Payback period, Discounted payback period, Average rate of return, Net present value, Profitability index, IRR and Modified IRR (Theory & data interpretation): Sekhar, Chandra: 9781980203452: Amazon.com: Books

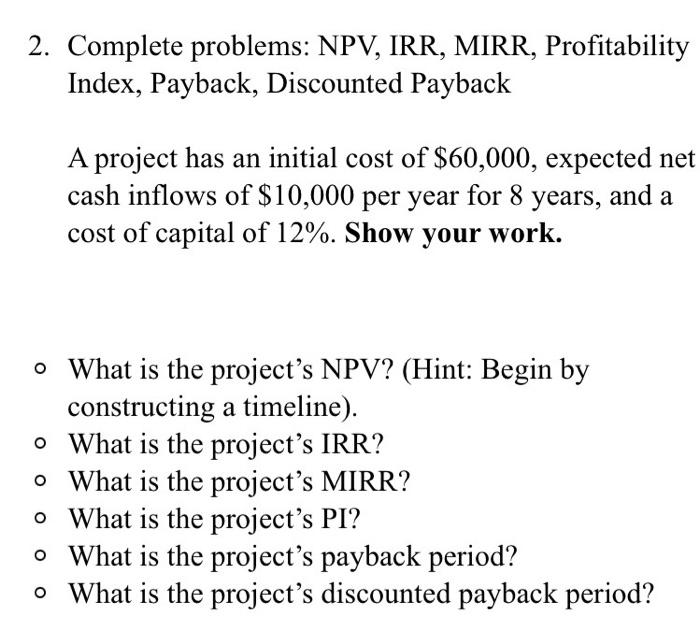

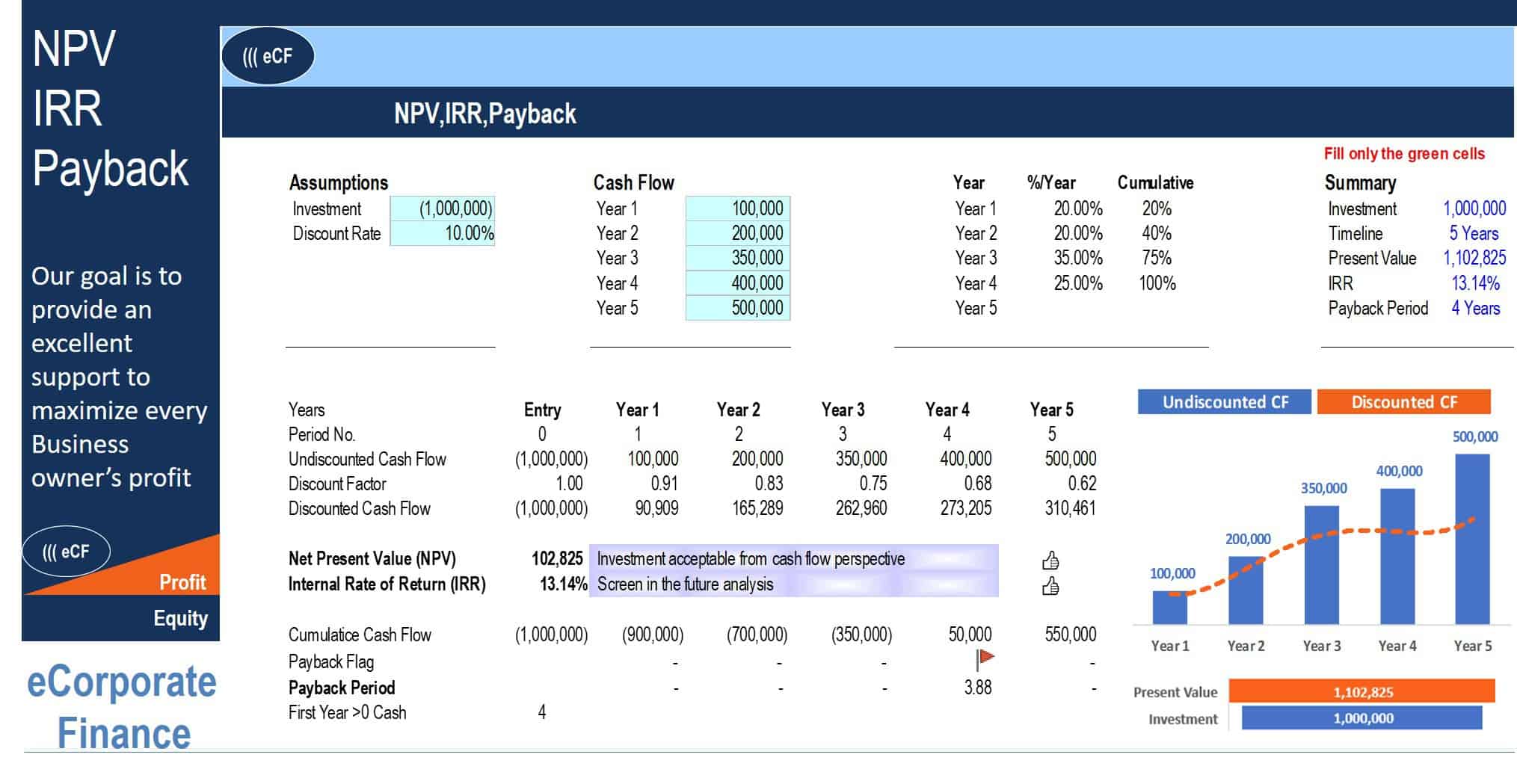

Net Present Value (NPV), Internal Rate of Return (IRR), and Payback - University of Cincinnati - Lindner College of Business

CAPITAL BUDGETING: decision methods - PBP, DPBP, ARR, NPV, PI, IRR, MIRR (theory and interpretation)... by Chandra Sekhar | Goodreads

Amazon.com: CAPITAL BUDGETING DECISIONS: PBP, DPBP, ARR, NPV, PI, IRR & MIRR (Theory & interpretation Book 1) eBook : Sekhar, Chandra: Kindle Store

:max_bytes(150000):strip_icc()/NPVFormula-5c23ea8f46e0fb00013d2624.jpg)